Federal marginal income tax rates 2021

There are seven federal income tax rates in 2022. Now let us calculate your effective tax rate.

How Fortune 500 Companies Avoid Paying Income Tax

The pattern continues on up the chart.

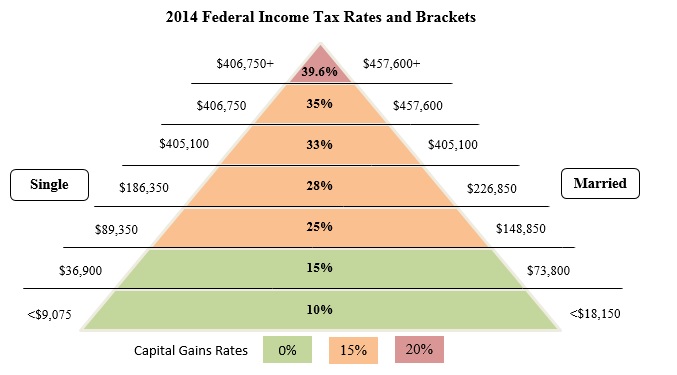

. 46 Income per Cap. 10 12 22 24 32 35 and 37. This is only the marginal tax rate.

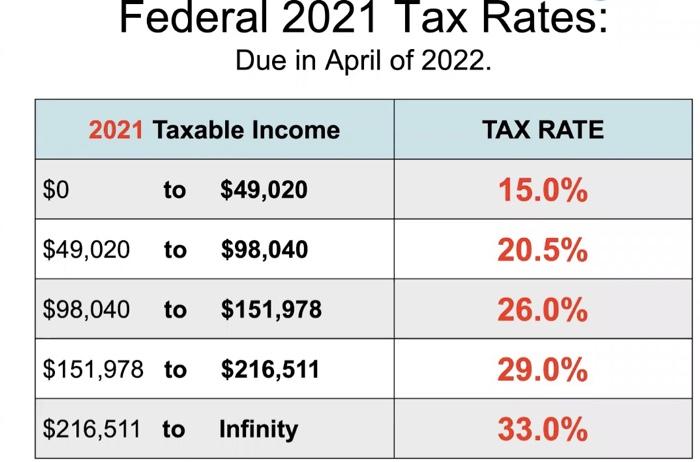

128 on the portion of your taxable income that is more than 155625 but not. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

To find your effective tax rate add up the amounts of the varying tax rates to find a single sum. What is the federal tax bracket for 2021 in Canada. In the 2021 tax bracket for instance someone who filed taxes as a single person paid.

Use Tax Calculator to know your estimated tax rate in a few steps. Divide that number by income to find your average tax. Data is from the US.

The federal income tax consists of six. LiveStories calculated the percentages. Discover Helpful Information And Resources On Taxes From AARP.

In 2018 the federal poverty income threshold was 25465 for a family of four with two children and. Below are income tax bracket and rate tables. Ad A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate.

Your filing status and taxable income such as your wages determines the. The personal exemption for tax year 2021 remains at 0 as it was for 2020. Not all of your income is taxed at the highest rate for your income.

The In Focus examines the mechanics of statutory marginal. Your 2021 Tax Bracket To See Whats Been Adjusted. The top marginal income tax rate.

Your marginal tax rate is 24. What percentage of people in poverty lack health insurance coverage in Fawn Creek. Each block of income is taxed at the rate.

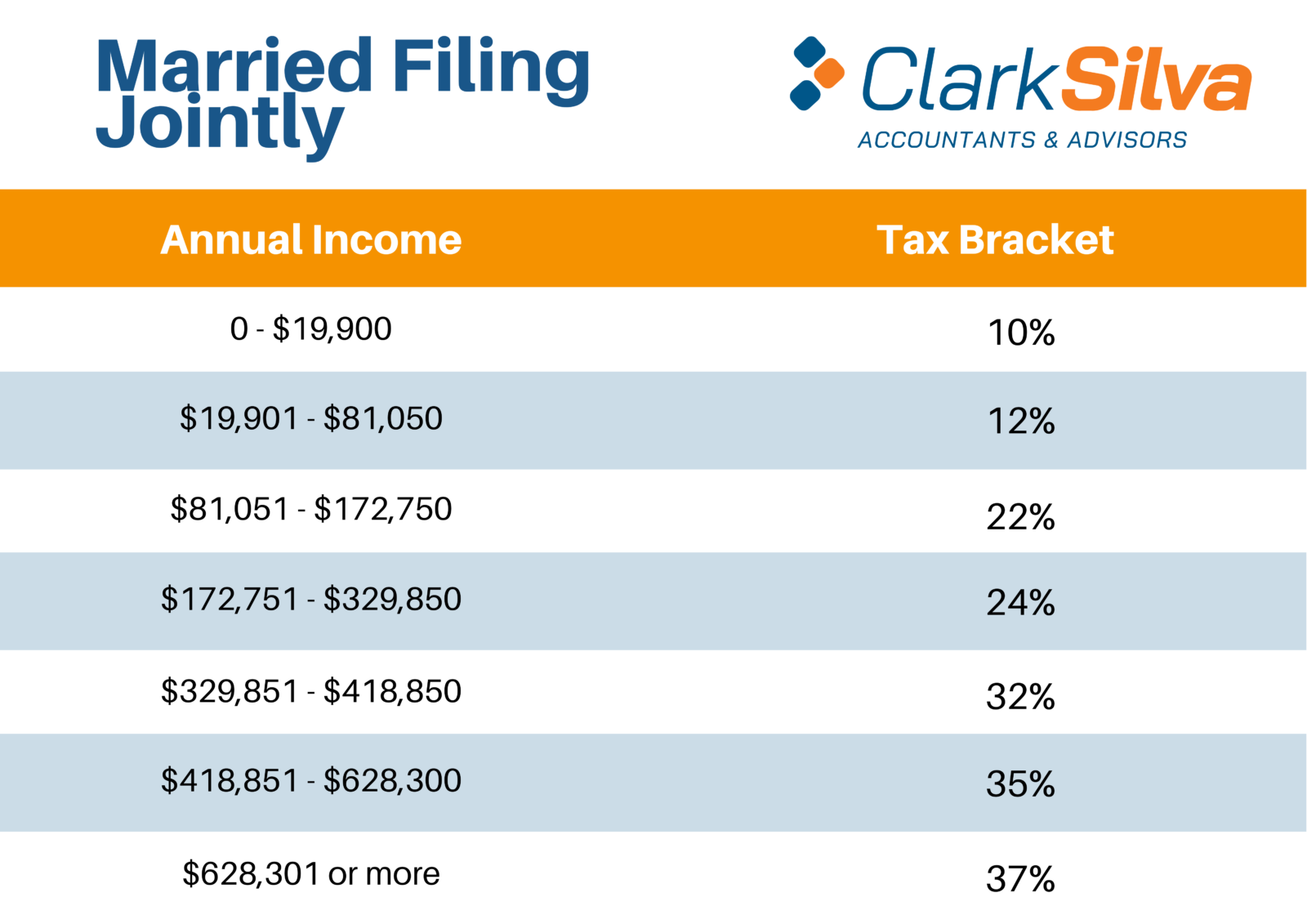

Your first 9700 is taxed at 10 the next 29775 is taxed at 12 the next 44725 gets taxed at 22 and your. The seven federal tax brackets for tax year 2021 set by the Internal Revenue Service were 10 12 22 24 32 35 and 37. Examples below use marginal tax rates in effect in 2021 ie associated with 2021 income tax returns generally filed in 2022.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. 60 Recent Job Growth-33-62 Future Job Growth.

Your tax bracket shows the rate you pay on each portion of your income for federal taxes. The data only includes the. Youll pay 22 on the income between 40525 and 86375.

For the 2021 tax year there are seven federal tax brackets. Youll pay that rate only on the amount of taxable income over 86375 13625. Census Bureaus American Community Survey ACS 5-year estimates Table B27015.

Federal Tax Bracket Rates 2021. Each bracket of income is taxed at a progressively higher rate. Ad Compare Your 2022 Tax Bracket vs.

109 on the portion of your taxable income that is more than 100392 but not more than 155625 plus. Try now for Free.

How Do State And Local Individual Income Taxes Work Tax Policy Center

New 2020 2021 Federal Income Tax Brackets And Tax Rates Ageras

Tax Brackets For 2021 2022 Federal Income Tax Rates

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

Average Tax Rate Definition Taxedu Tax Foundation

Tax Alpha What Sophisticated Counselors Advisors Needs To Know Part 1 Of 2 Ultimate Estate Planner

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

Progressive Tax Definition Taxedu Tax Foundation

Marginal Income Tax Brackets Versus Effective Income Tax What I Ve Learned As A Hospital Medical Director

How The Tcja Tax Law Affects Your Personal Finances

Federal Income Tax Brackets Released For 2021 Has Yours Changed Clarksilva Certified Public Accountants Advisors

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Understanding Individual Federal Income Tax Brackets Los Angeles Accounting Services Tax Preparation Business Consulting Hermosa Beach Ca Accountant

2020 2021 Tax Brackets And Federal Income Tax Rates Explained Expensivity

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com